On the Ingenico 40th anniversary, let’s have a look on the early years of the company short after Roland Moreno’s invention of the smart card in 1974.

500,000 francs and four employees…

In 1980, Ingenico could never have anticipated how its future would play out and the influence it would have in the field by revolutionising our payment practices.

Modems, magnetic stripe cards, smart cards: from its inception, the company would make the most of every technological breakthrough, offering ever more efficient payment terminals and making tremendous inroads in highly competitive emerging markets.

Back in the 1970’s in France, electronic payment technology appeared in conjunction with the very first payment terminals. The Carte Bleue network had existed since being founded in 1967 by BNP, CCF, Crédit du Nord, CIC, Crédit Lyonnais and Société Générale. The new credit facility offered by this card was gradually adopted by retailers and cardholders as they became familiar with automated teller machines and card imprint machines. During the 1970’s, the agreement signed by the Carte Bleue consortium with Visa International and creation of the Eurocard France network would lay the groundwork for nationwide implementation of a card-based payment practice.

It was against this backdrop that Jean-Jacques Poutrel and Michel Malhouitre founded the French limited company Ingenico in 1980. They began with a capital of 500,000 French francs and a staff of four. From the outset, the two men sup-plied the hotel sector with an automated billing system. As an extension of the experiences gained with this initiative, they designed a payment terminal that, read a card’s magnetic stripe and then remotely transmitted data via new integrated modems. They replaced card imprint machines and the awkward sequence of manual operations. This stream-lining would mean that verifying card numbers from a list of lost or cancelled cards, calling an authorisation center for high purchase amounts, and delivering card purchase receipts to bank branches would no longer be required.

Terminal prototypes were produced in rapid succession, until Ingenico came up with the first device offering the potential for industrialisation, i.e. the CART’EL in 1982. Duly impressed, the Carte Bleue network ordered 100. So why only one hundred? Because this small engineering company would have been incapable of producing more. Then came a joint venture between Ingenico and the CSEE Signal and Electric Engineering Company: CSEE was to manufacture the Ingenico terminals under license and then distribute the machines under the brand name Monic 1800. Shortly after, several thousand units of this model (renowned for its metal body sandwiched between two wooden flanges) were sold.

First explorations outside of France

The CSEE company, already active in the export market, was interested in marketing the Monic 1800 terminal beyond France’s borders. The opportunity would present itself in 1983, through a partnership with the Burroughs company, which at the time was seeking electronic money hardware to service Australian banks.

A smash hit in Australia and New Zealand.

Since the aesthetics of Monic 1800 were deemed inappropriate for the Australian market, its appearance had to be revamped, and the Monic 1810 in Australia and New Zealand, as well as in France, gaining popularity across the network of Total petrol stations. A bank card model would also be produced; in 1984, a new consortium was formed combining member banks of both French branches of the Visa and MasterCard networks.

In 1985, Ingenico took on a new dimension. The company relocated into more spacious premises in Puteaux to the west of Paris; it also terminated the collaborative venture with CSEE, in order to manufacture and market its devices directly while moving into new markets like large-scale retailing. This same year, Ingenico was listed on the Paris Stock Exchange secondary market.

A huge transition

The new adventure was underway, using a range of hardware and applications library that would o expand.

Above all else, 1985 will be remembered as the year of a major technological shift. French banks made the big decision to migrate in favor of the “memory card”, also known as the smart card, invented a decade earlier by Roland Moreno. A memory card consortium had been created in 1980 by the leading French banks, with the aim of using the smart card as a new means of payment. Ingenico was quick to respond by proposing adapted terminals capable of rea-ding chips as easily as the magnetic stripe.

The first smart cards were circulated as of 1986, and Ingenico participated in a number of presentations and experiments, such as during the month of February 1985 when it equipped all retailers in the ski resort of Tignes for the freestyle skiing world championships. In 1987, Ingenico’s listing on the Paris Stock Exchange was transferred to the monthly settlement market. On top of everything else, this worldwide referencing recognition would set the stage for a resolute merger & acquisition policy. In 1987 the company’s first subsidiary in Australia was also founded.

The end of the 1980’s

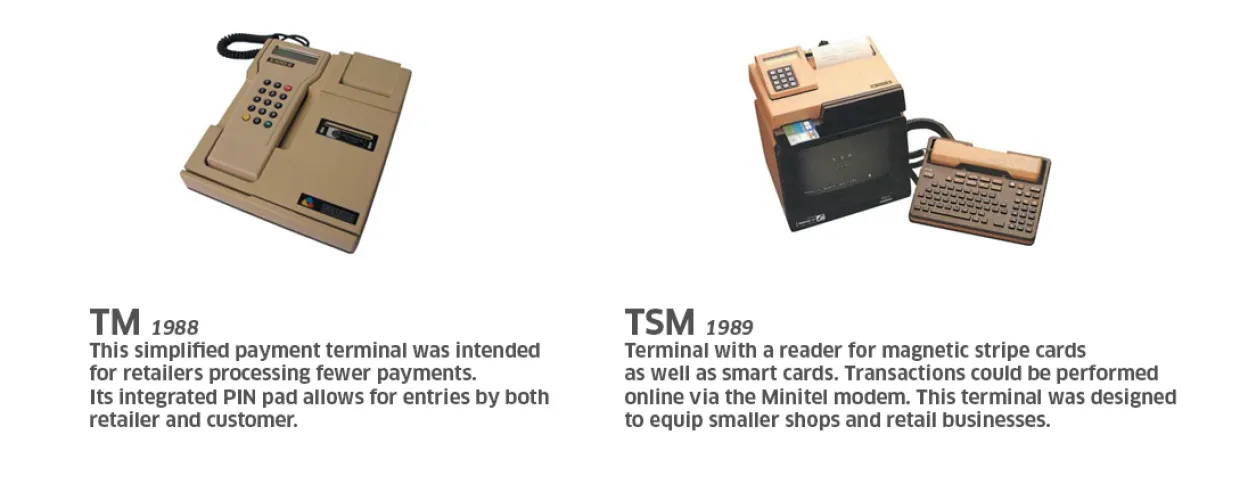

Ingenico’s product line was bolstered by low-cost, so-called “simplified”, equipment like the TM, a terminal whose PIN pad also served as a keyboard for retailers, and the TSM, which could operate online as a Minitel peripheral. The number of bank cards, Visa, MasterCard and credit cards was growing exponentially. In very little time, a new hard-ware / software architecture had become mandatory, thus guaranteeing the tight overlap between applications processing for each type of card.

In 1990, Ingenico launched the Euro*mos program, which in turn gave rise the next year to the UnicaptTM platform, providing the infrastructure for creating all of the next decade’s products, with an architecture successively offe-ring 8-bit (U8), 16-bit (U16) and 32-bit (U32) versions.

The new adventure was underway, using a range of hardware and applications library that would continue to expand.