The Future of Terminal as a Service: What’s Next for Ingenico’s TaaS?

Terminal as a Service (TaaS) was launched by Ingenico to equip users with an end-to-end terminal estate management solution which provides services to support the terminal during its lifetime.

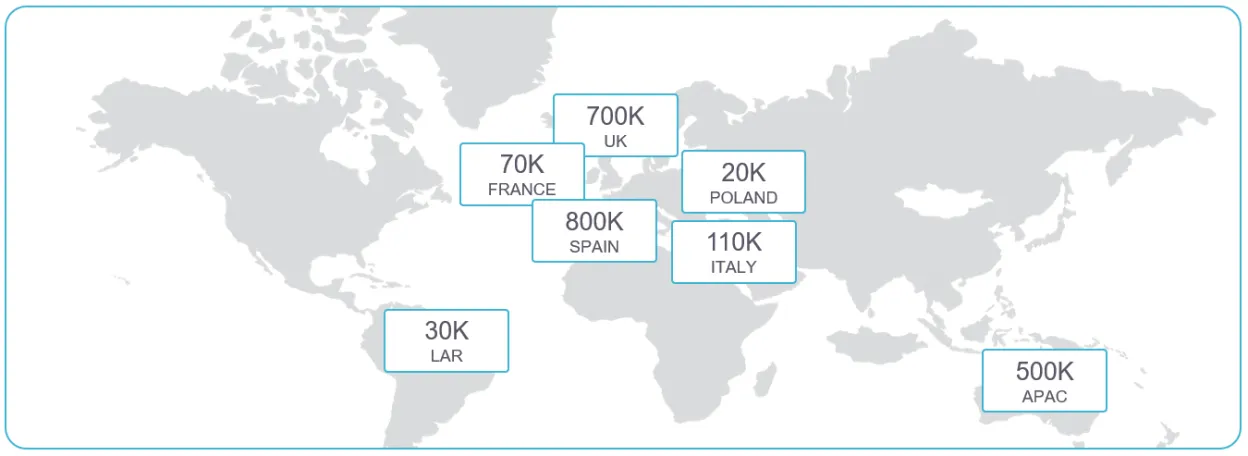

Its introduction has proved a great success, with over 2.2M payment terminals now managed through TaaS, reducing costs, and allowing organisations to focus on the merchant experience.

But no service can stand still, and demand for improved operational efficiency is stronger than ever. So how can Ingenico improve TaaS and maintain its relevancy?

We spoke to Hernán Moya, Global TaaS Business Development Director, to see where TaaS is going and whether digital innovation will have a role to play.

How Fintech Growth and ISV Influence Are Reshaping Demand for TaaS

What are the current market changes directly influencing the need for TaaS?

The payments ecosystem never stays still for long, which makes it a very interesting place to be - though it can be difficult to keep up!

The key challenge currently facing our customers is the competitive nature of the market which is being disrupted by Fintechs and ISVs. For example, in the US, Ingenico’s own research has shown that ISVs now channel over 20% of payment solutions and they are growing twice as fast as the rest of the market. In some verticals, ISVs are taking as much as 40% to 50% market share.

This evolution is changing the way payment terminals are being purchased, altering the direction of the market. Now, estate managers must differentiate their offer to maintain a strong value proposition, switching from traditional commoditised products to bring something special to maintain business growth. This need is being accelerated by new Fintech players creating a more challenging competition. In response, banks and acquirers are seeking to verticalize their offerings through value-added apps and alternative payment methods.

How Operational Efficiency in Terminal Management Drives Business Success

So, how does operational efficiency in the management of terminals and services address these challenges and contribute to the success of an organisation?

Terminal as a Service enables estate managers to remove the complexity of managing a terminal estate so they can focus on their own customers. Ingenico acts as a custodian of the hardware, software, and services management, freeing estate owners to concentrate on competing in the areas in which they can add value, as well as any other challenges that go beyond payment.

TaaS is a very different way of doing business based on a partnership in which we manage of a big part of the payment value chain. This is particularly beneficial where a customer needs to bundle TaaS in several different countries. They decide the strategy, and we support as the payment terminal expert, helping to make estate renewals more efficient and bringing improvements to the quality of service.

By leaning on us to deliver the operational requirements of managing an estate, dealing with multiple suppliers, terminal maintenance, handling calls and so on, they can focus instead on business growth and launching with a faster time to market.

Proven ROI: What Independent Analysis Reveals About TaaS

Ingenico recently completed an independent study on the economic impact of TaaS. Has this proven the benefits of the service?

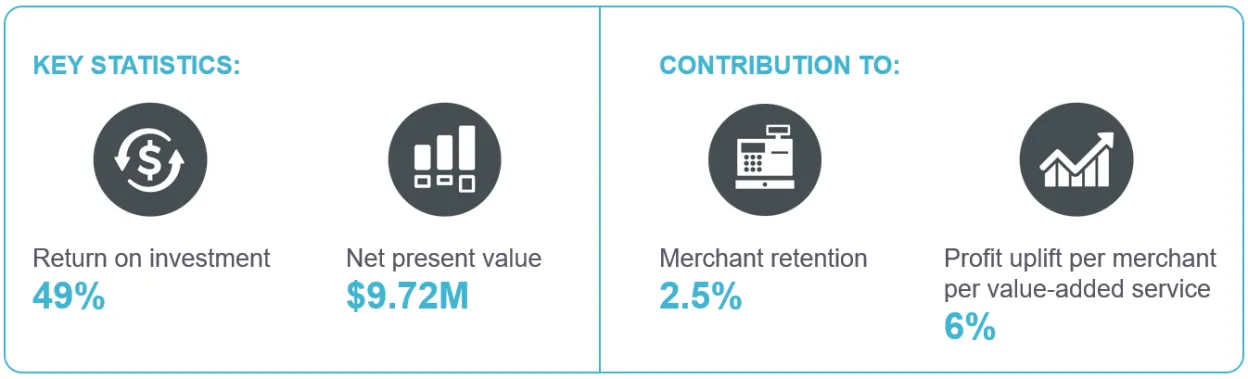

TaaS is a great solution to reduce the total cost of ownership by improving efficiency and economies of scale, no matter the size of the organisation or terminal estate.

So, we are delighted that our belief in the strong advantages it brings to our customers have been validated by independent research which included existing customer feedback.

The key findings and quantified benefits of TaaS found by the Forrester TEI study were:

- The elimination of upfront capital costs

- Estate management costs reduced by 30%

- Vendor management effort is decreased

- Merchant retention is increased by 10%

- Increased profit from value-added services

- The freedom to reassign development resources to other projects

For more in-depth information, please download the study: https://insights.ingenico.com/TaaS-TEI-Forrester-research-emea-comm-activities.

How TaaS Accelerates the Transition to Android Smart Terminals

Many estate owners are moving to Android smart terminals, what can TaaS bring to these devices?

Most estate owners already have a structure and years of experience, so we know that the switch to TaaS is not an easy decision. In most cases, we start by introducing a new set of terminals, such as Android, injecting them steadily in parallel to their current estate. When this phase is completed and the benefits visible to the customer, we switch to full buy-back estate management. So, it’s a ‘step by step’ approach to introduction.

Conversely, for those already applying the TaaS model, we can speed up the time to market and facilitate a faster move to Android technology. There is no difference in the support provided, and once Android is introduced, customers benefit from a more modern fleet with new business applications and revenue streams.

How the New TaaS Digital Experience Is Transforming Merchant Support

There are some exciting changes coming to TaaS, what can you tell us about the ‘Digital Experience’?

Indeed, Ingenico is working hard on a new TaaS Digital Experience which will improve the service given to merchants by automating and digitalising several processes across the terminal lifecycle value chain.

The model consists of new Digital Support Services combined with our Terminal Remote Capabilities. These services are already being piloted and will change the way we communicate with our customers through the ‘My Ingenico’ app and a Chatbot which will improve our capabilities to manage terminals remotely. Services will include the auto installation of terminals, the ability to problem solve in minutes and the performance of self-diagnosis checks.

With the TaaS Digital Experience, merchants won’t have to wait to speak to the call centre or for a technician to arrive. Instead, they will have the tools to solve any problem by accessing our app or digital channels, 24 hours a day.

Terminal as a Service is adapting service delivery to the new world of commerce, and it’s exciting to be part of the journey!