MPoC secures payments on consumer devices, gives developers more flexibility to meet standards, and paves the way for more merchants to accept digital payments.

In November 2022, the Payment Card Industry Security Standards Council (PCI SSC) published the Mobile Payments on COTS (MPoC) standard for payment acceptance on consumer off-the-shelf (COTS) devices. MPoC builds on two existing PCI standards: Software-based PIN Entry on COTS (SPoC) and Contactless Payments on COTS (CPoC). The MPoC standard will provide increased flexibility in how payments can be accepted on COTS devices and how new solutions can be developed.

Tim Dziubek, Director of Product Strategy for Discover Global Network, comments, “By incorporating emerging contactless payment use cases such as PIN, offline transactions and signature, the MPoC standard will drive greater choice and functionality for merchants and their customers. In addition, MPoC offers flexible certification options, easy implementation, and robust security measures, which should increase participation within the space.”

What’s Different About the MPoC Standard?

Previous software-based payment acceptance standards addressed different use cases. SPoC provided the security standards for using an external card reader with a mobile device. CPoC uses near-field communication (NFC) to receive payment data on consumer devices but doesn’t enable PIN entry. However, MPoC addresses contactless payment acceptance and PIN verification to increase security.

MPoC also decreases the complexity developers face when trying to comply with both SPoC and CPoC and enables creating solutions for different types of mobile devices. MPoC also takes a different approach to the other two standards. It includes objective-based security requirements rather than prescriptive requirements. Developers have the latitude to determine the best way to protect encryption keys, the attestation and monitoring (A&M) component, and patent assets. As a result, the MPoC standard will give developers more flexibility to move tap-to-phone solution adoption forward.

Why MPoC is a Game Changer for Payments

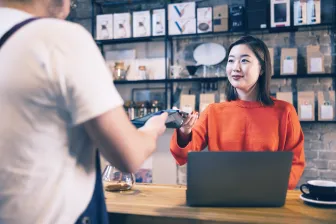

With a practical way to develop software-based payments and standards to secure them, acquirers and merchants will have more options for payment acceptance. Merchants can hold out a smartphone or tablet, and consumers can tap a contactless card or mobile wallet to quickly make a tap-to-phone payment.

The impact on digital payment adoption will likely be substantial. Small and micro businesses that have limited ability to accept payments can begin to use smartphones to accept digital payments at farm stands, community events, sporting venues, and food truck counters. Businesses that couldn’t (or couldn’t afford) payment technology for contactless payment acceptance will have a simple, cost-effective option. Additionally, field service technicians could use COTS devices to accept credit card payments for home repairs, HVAC maintenance, landscaping, and other services without having to carry a separate device.

Additionally, the acquirers and solutions providers that provide these businesses with merchant services will benefit from simpler, faster onboarding. There’s no need for key injection for the merchant’s terminals. As soon as merchants are approved, they can, if they choose, use the mobile devices they currently use to accept payments.

Furthermore, payment solutions developed with the PCI MPoC standard will provide all sizes of merchants doing business in all segments with the ability to enhance customer experiences and operate more efficiently. They could set up additional lanes easily during high-traffic times without investing in payment terminals they wouldn’t need at other times of the year. Businesses could accept payments curbside for add-on items for online orders or anywhere they’re providing service, including at the front desk, in the taxi, in a store’s aisles, during a consultation, or at a table in the dining room.

And thanks to the MPoC standard, they can accept those payments securely.

To learn more about MPoC and how Ingenico is using it to innovate payment solutions, contact us.