The Truth About Biometric Payments Data Privacy

Listen to this article

Biometric payments make checkout faster and easier, but the adoption of this innovative technology depends on trust. Consumers want to know that merchants and banks will only use their biometric data for payments, not other uses, and scans are stored securely. Ingenico has created a system with non-reversible scans, tokenized payment data, and secure consumer information storage to build trust while delivering great user experiences.

Index

-

What Is Biometric Payments Data?

-

Consumer Concerns About Biometric Payments Data

-

How to Protect Biometric Payments Data

-

Optimizing the Risk-Benefit Analysis of Biometric Payments

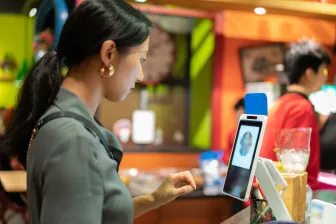

Biometric payments are a promising solution to a long-time problem: checkout speed. Shoppers in the APAC region continually seek faster, low-friction ways to transact, and biometric payments meet those expectations. Biometric payments can even combine with access control for seamless entry to events or with loyalty rewards for streamlined points redemption. Implementing these solutions will improve merchant processes, shorten lines, and increase customer satisfaction.

However, consumers are not willing to trade data privacy for that convenience. The Fintech Times reports that although 74% of APAC consumers see this quick, convenient payment method as more secure than traditional payment methods. However, 78% are concerned about who can access their data.

What Is Biometric Payments Data?

The data that a payment terminal collects, including payment method and customer details, allows a merchant to complete digital transactions. When consumers use biometric payments, the solution uses data to match their physical characteristics to authenticate their identities and authorize payments. So, consumers must agree to have a scan on file so the system can match it to their payment accounts.

The type of biometric authentication can vary:

-

Fingerprint authentication is popular on smartphones or other consumer devices; however, because touching the sensor is necessary, it didn’t catch on in retail settings due to hygiene concerns.

-

Facial recognition is more popular in the region than in other parts of the world, and KBV Research predicts a compound annual growth rate (CAGR) of 15.3% from 2024-2031. However, IAPP points out that these systems can be prone to biases and misidentification.

-

Palm vein scanning, which eliminates the shortcomings of other methods, is emerging as the leading option for biometric payments. With palm vein biometric payments, consumers wave their hands over a near-infrared (NIR) sensor. The system creates a unique digital map of each consumer’s palm veins. When it's time to pay, consumers wave their hands over a sensor at the checkout to pay. They stay in control, and no one sees the scan, making the payment authentication private. Furthermore, the palm vein biometric payments solution meets the need for fast, frictionless payments.

Consumer Concerns About Biometric Payments Data

For consumers to willingly enroll in biometric payments, they need the assurance that their data is protected. Biometric authentication is becoming more common for other purposes, such as passports and law enforcement. Consumers want to know that if they intend for their biometric scan to allow them to make payments, merchants and players in the payment chain will use it only for payment transactions and no other reason.

Using a system from a well-known provider can help build trust. When merchants choose a biometric payments solution from a provider with a long history of securely capturing data for transactions, they can tell customers with confidence that payment data is private and protected.

How to Protect Biometric Payments Data

Payment companies bringing biometric payments data solutions to market need to address consumers’ concerns in addition to creating a fast, efficient system. Ingenico’s palm vein biometric payments solution reflects careful consideration of data security and privacy, from how it’s constructed to how consumers use it. The solution is:

| Features of a Secure Biometric Payment System | |

|---|---|

| Non-reversible | The system uses a one-way algorithm, so it can never recreate the end user’s scan. |

| PCI DSS-compliant | It stores account data by keeping a token of the payment card, so a breach would not yield human-readable data. |

| Data-segmented | The system has separate databases, so permissions and contact information for receipts are stored apart from the scan and payment card information. |

Reliability is also essential. Ingenico chose a biometrics solution that the developer had tested on millions of people to prove accurate matches.

Optimizing the Risk-Benefit Analysis of Biometric Payments

With any technology implementation that uses protected consumer information and payment data, some risk for merchants and banks exists. Ingenico has worked hard to create a system that enhances payment experiences while minimizing risks. The system allows consumers to wave their hands to pay, so they don’t have to carry cards or even a smartphone with a mobile wallet or payment app. Merchants can give them the convenience of using coupons, redeeming or collecting loyalty rewards, and verifying their ID for age-restricted purchases, all with one simple gesture. At the same time, the solution protects biometric data and payment information so customers can use it with confidence.

Ingenico stands apart with a solution that does it all, and momentum is beginning to build. Contact us to learn more about a truly effective way to solve the problem of transaction speed.

FAQs

What are biometric payments?

Biometric payments are payment experiences that use a person’s unique biological traits—such as a fingerprint, palm‑vein pattern, facial features, or iris—to verify identity and authorize a transaction. Instead of a PIN, password, or card swipe, the biometric data is captured at the point‑of‑sale (POS) and matched against a secure template, instantly confirming that the shopper is the rightful owner of the payment method.

What type of data is collected in biometric payments?

Biometric payment terminals store a digital template of these traits (never the raw image) and match it in real time to authorize the transaction. This eliminates the need for PINs or cards while delivering strong fraud protection.

What makes palm vein scanning more secure than other biometric methods?

Palm‑vein scanning protects payments by using a deep, invisible vascular pattern that is extremely difficult to replicate, coupled with hardware anti‑spoof measures and PCI‑compliant encryption. This makes it intrinsically more resistant to cloning, photography, or presentation attacks than surface‑level biometrics such as fingerprints or facial recognition.

How accurate are biometric payment systems?

Biometric payment terminals are engineered for payment‑grade accuracy: they meet industry‑approved security certifications, incorporate hardware anti‑spoofing, and (especially with palm‑vein) use an internal biometric that is inherently harder to fake. While the exact numerical FAR/FRR values are not disclosed in the public assets, the documented compliance and technology choices indicate very low error rates suitable for high‑volume retail and financial‑inclusion deployments.

What is the risk‑benefit balance of biometric payments for merchants?

Biometric payments give merchants a powerful tool to reduce fraud, speed up checkout, and reach new customer segments, while the primary risks are privacy compliance, implementation cost, and occasional usability hiccups—all manageable with proper processes and the support resources Ingenico provides.