Ingenico is taking a new approach to payment transactions for a more sustainable and inclusive growth

How can payment solutions be changed into a driver of sustainable development and corporate social responsibility (CSR)? While more and more companies in the retail sector are adopting solidarity rounding, allowing customers to make micro-donations when they pay, other solutions are also emerging to create social value from payment transactions, while reducing the carbon footprint linked to the purchasing act.

Committed for many years to promoting a more responsible development, Ingenico - the global leader in seamless payments - plans to step up its efforts and launches “SHARE”, a CSR programme based on tangible goals. This programme follows on from the measures already initiated by the Group in 2015 and is based around four key focuses: governance, corporate citizenship, human capital and environment. The aim of the programme is to address the key issues that Ingenico has identified in the payment sector, whether these are social, economic or environmental.

Carbon impact: the payment sector has a key role to play

In today’s world, consumers want and expect companies to have a front-line role in the fight against climate change. The act of purchase is not carbon-neutral: as with the printing of any paper document, issuing a payment receipt1 results in CO2 emissions. To support retailers’ energy transition, Ingenico has created digital ticket solutions and is committed to developing these alternatives to paper payment receipts.

While digital till receipts are becoming more widespread, regulatory obstacles still delay payment receipts’ move from paper to electronic format in several countries. And yet the resulting carbon footprint reduction would be enormous! We at Ingenico estimate that this reduction would be of 30% if payment receipts were sent by email and 99% if sent by SMS.

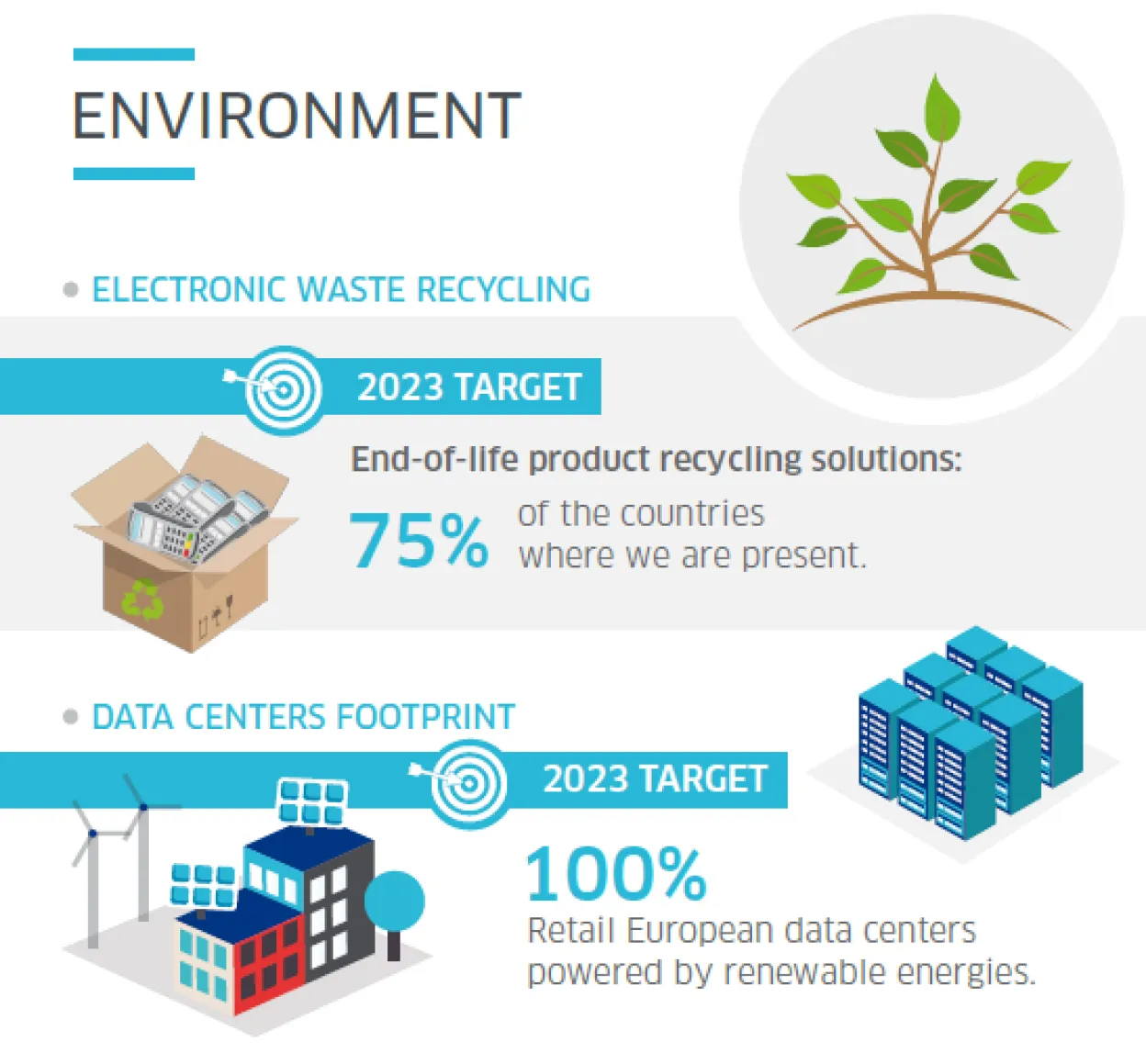

In addition, companies that manufacture terminals, like Ingenico, have a role to play in their recycling process. Therefore, we care to develop systems to collect terminals at the end of their lives and these solutions are now available in 81% of the countries where we operate. We are also making efforts to ensure that, in the long term, we will work exclusively with European data centres powered by renewable energy.

Payment as a driver of social inclusion

Ingenico strives to achieve a more inclusive economy. While extreme poverty is generally falling worldwide, significant inequality nonetheless remains, particularly in terms of access to basic financial services. To move financial inclusion forwards, Ingenico and its partners are developing a branchless bank model, relying on local merchants.

We have also developed an offering that meets NGOs’ specific needs: Ingenico provides discounted access to its online payment solution for fundraising purposes to over 200 NGOs in an extremely wide range of sectors such as the environment, education and health.

After collecting more than 19.5 million donations volumes, among which 17 million micro-donations via our payment terminals, as a result of our partnerships with microDON in France, Pennies in the United Kingdom and Worldcoo in Spain, we get closer to our target objective to double the total number of donations made via our solutions each year between 2018 and 2023, reaching 20 million donations annually. And we hope to maintain this momentum!

Parity: a crucial driver of business performance

Conscious of the fact that parity boosts performance, Ingenico is committed to promoting equal opportunities and to supporting women’s professional development within the company. In France, Ingenico’s female-male gender equality index is 89/100. This encouraging result is a testament to the Group’s long-term commitment to a culture that values diversity in all its forms and spurs us on to continue with and extend our HR policy on parity.

Today, 31% of the Group’s team members are women, which is average for the sector. Our goal is to increase this figure to 35% by 2023. In the meantime, even though our Executive Committee has reached parity2, there is still room for progress as we want to reflect the same diversity at all managerial positions. We want to reach the objective to 30% of women at managerial positions by 2023. To reach that objective, we have set-up a structured plan based on a proactive recruitment policy.

The act of making payments - something that is ingrained in our everyday lives - must be a responsible act. Ingenico, as a global player, has set itself the task of making this act not only cleaner and more inclusive but also of giving it a new role - an act that can make a positive impact on society.

1 The payment receipt is different from the till receipt.

2 Ingenico Group is among top 10 French stock exchange SBF 120 companies with the most important female representation in ExCos. (as of December 2019).