In the ever-evolving landscape of financial transactions, the shift towards simpler, more cost-effective payment methods, balanced with the critical need for security and compliance, is becoming increasingly apparent. Drawing insights from industry experts Philip Glickman and Lewis Sun, this blog explores how these changes are reshaping the way businesses handle transactions, offering a window into the future of payment systems.

Simplifying Payment Acceptance and Reducing Costs

Philip Glickman, formerly Managing Director at J.P. Morgan, observes:

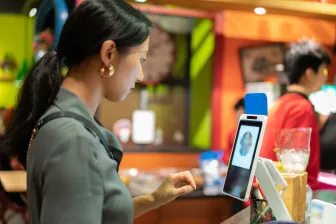

Glickman’s statement highlights a significant shift in the industry. The simplification of payment systems, like the use of QR codes, represents a move away from traditional, complex processes. This evolution not only makes it easier for merchants to accept payments but also reduces the cost associated with payment acceptance. The implication is a more accessible and financially feasible landscape for businesses of all sizes.

Balancing Security and Compliance in Payment Systems

Lewis Sun, Head of Domestic & Emerging Payments for Global Payments Solutions at HSBC, comments:

Sun’s perspective sheds light on the dual aspects of security and compliance in payment systems. As the market evolves, so do the requirements for a secure and compliant transaction environment. The emphasis is on creating robust infrastructure while controlling risks. This approach involves not just adopting advanced technology but also ensuring effective operational flows, governance, and a compliance-oriented mindset. It's about striking a balance between innovation and risk management to provide maximum benefit while maintaining security and regulatory compliance.

Conclusion

The transformation in payment systems as described by Glickman and Sun reflects a dynamic industry adapting to new technologies and regulatory demands. The move towards simplified, cost-effective methods of payment acceptance, combined with a strong emphasis on security and compliance, underscores the industry's commitment to innovation and risk management. These changes are not just redefining payment processes but are also setting new standards for the entire financial sector.