A Practical Approach to Payment Device Management

Listen to this article

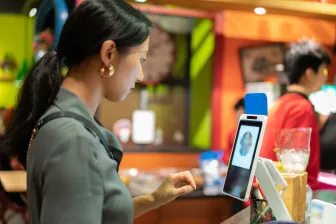

Consumers expect fast and efficient service if a brand wants to gain their loyalty. Merchants are reimagining commerce, while eliminating checkout queues addresses a key concern, businesses must also look beyond that challenge to create a more seamless and engaging customer experience. Innovative point of sale (POS) and payment solutions enable transactions in the aisles with mobile devices and at self-service kiosks so customers can manage checkout on their own. More devices - at the checkout counter and beyond - allowing merchants to accept payments wherever customers engage are elevating experiences and enhancing operational efficiency. However, doing business in this new world of commerce raises the question: What’s the best device management solution?

Acquirers and other merchant service providers (MSPs) know a combination of spreadsheets and homegrown systems is not the answer. Furthermore, device management systems that were not specifically designed for payment devices, like mobile device management (MDM) solutions, may help automate some tasks but still leave gaps that IT teams need to spend time and effort to fill. The best strategy is to implement a solution designed specifically for Point-Of-Sale equipment management.

Features of the Optimal Payment Device Management Solution

Comprehensive lifecycle management for payment devices requires a solution designed specifically to increase efficiency and visibility for MSPs and their customers. Device management solutions that provide the most value have built-for-purpose features, such as:

- Remote Configuration

A cloud-based device management system enables communication with payment terminals deployed in the field as long as they can connect to the network, from a team physically based elsewhere. Remote capabilities are beneficial throughout the life of the device, starting with initial ”out-of-box” experience. A solution that supports remote key injection (RKI) allows the manufacturer to ship directly to the merchant rather than to a key injection facility. RKI saves money on shipping and secure storage and eliminates concerns that devices injected with encryption codes could be lost or stolen on their way to the merchant.

- Geolocationing

Knowing where payment devices are at all times is necessary for Payment Card Industry (PCI) compliance. Manually confirming the location of all devices in an estate is time-consuming and creates the opportunity for errors. A device management solution that tracks Android terminals and other devices allows acquirers, MSPs, and merchants themselves to immediately know their precise locations.

- Issue Resolution and Prevention

Ensuring reliable payment devices operation is necessary to providing great customer experiences. However, retail or restaurant employees often don’t have the confidence to address issues that arise without help. Device management solutions can let them request service directly from the device. Screen sharing, with permission, allows a technician to take control of the device to troubleshoot and, often, resolve issues without on-site service. The process is much quicker than a help desk trying to guide an employee through steps needed to get the device back online. Additionally, leading solutions will enable acquirers or MSPs to run terminal diagnostics to check device health. This allows the payment solution provider to address issues proactively, replacing devices that need service before downtime occurs.

Benefits of a Full-Featured Payment Device Management Solution

While a solution designed specifically for payment device estate management keeps devices working at top performance with less effort by the merchant, it has measurable benefits for the acquirer or MSP. It keeps total cost of ownership (TCO) low by:

- Saving Operations Teams’ Time: Device management with remote capabilities reduces help desk calls and resolves issues more quickly.

- Ensuring Compliance: A solution designed specifically for payment devices makes device location tracking and compliance reporting easier.

- Mitigating Risk: A purpose-built device management solution enhances security with device visibility, sending alerts when a device is unexpectedly offline and blocking them from reconnecting without confirmation that no fraudulent activity occurred.

Ready to streamline your estate operations? Access our white paper for practical guidance.