In just over a decade, contactless payments have achieved 80% penetration in Europe. In the Middle East, adoption is even higher: the Saudi Central Bank reports an impressive 94% contactless payments penetration for Saudi Arabia alone, driven by the widespread availability of smartphones and contactless-enabled cards. More than 50% of in-store transactions in the U.S. are now contactless, with use quickly growing over the last few years due to the COVID-19 pandemic. In Africa, the COVID-19 pandemic accelerated the shift toward contactless payments, resulting in 27.5 billion total transactions by the end of 2020. While adoption and usage vary between countries, one thing is clear: Tap-to-pay payments are on a steep growth trajectory.

Why Tap-to-Pay Payments Adoption has Skyrocketed

Tap-to-pay payments use is on the rise for several reasons, but these three factors are the primary drivers:

- It’s Easy

Using contactless cards and smartphones with mobile wallets is among the most convenient payment methods. With a tap, a customer completes a transaction. Consumers don’t have to carry cash in their wallets — or even a wallet. Overall, tap-to-pay payments reduce payments friction for the consumer.

- It’s Increasingly Familiar

As tap-to-pay options expand across industries, consumers are becoming more comfortable with this payment method. In many regions, allowing consumers to pay a transit fare with a contactless payment method has been an impactful introduction to this payment method. Consumers see how easy and time-saving it is to tap to pay, giving them the confidence to use it in more places.

- It’s Secure

Contactless payments use secure payment rails; however, using a smartphone to pay adds additional security feayures. For example, Apple Pay uses encryption and tokenization to protect cardholder data, and the Google Smart Tap feature in Google Wallet uses a virtual account number instead of the actual number when consumers pay. In addition, no one other than an authorized user can pay with a mobile wallet, especially when the consumer sets up biometric authorization to unlock it. Contactless payments also inherently protect cardholder data: No one sees account numbers or personal information during transactions, keeping them private.

How Payment Service Providers Can Equip Merchants to Accept Tap-to-Pay Payments Successfully

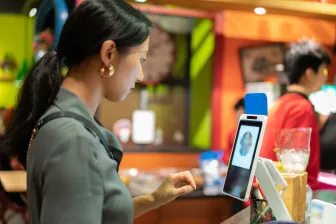

Tap-to-pay payments require near-field communications (NFC), so mobile wallets or contactless cards can communicate cardholder data with the payment terminal. However, optimizing that experience takes more.

Android terminals that run on an innovative payments platform that allows merchants to differentiate their businesses with the options their customers want. Android-powered tap-to-pay payments can deliver an entirely digital experience, including delivering e-receipts and integrating with loyalty and gift programs, streamlining both operations and payment experiences. A flexible Android platform can also support currency conversion for low-friction cross-border payments. Android offers the ability to tailor payment solutions to merchants' specific needs.

Add the Freedom to Accept Tap-to-Pay Payments Anywhere

In addition to enabling contactless payments on countertop and mobile terminals, merchants can also accept tap-to-pay payments on the mobile devices they already use. Ingenico SoftPOS lets merchants turn smartphones, tablets, or handheld computers into payment terminals. With SoftPOS, merchants can accept tap-to-pay payments without investing in new hardware. SoftPOS deploys quickly, often just by downloading an app. This technology also scales quickly, making it ideal for merchants of all sizes. Although SoftPOS is a valuable technology for small and micro-merchants, larger businesses can also benefit, expanding their ability to accept payments in more areas of the store and adding a reliable failover, enabling continued payment acceptance even in a network outage.

Meet the Demand to Tap-and-Go

The demand for tap-to-pay payments will continue to grow as consumers continue to embrace fast, easy, and convenient ways to transact. Ingenico offers a broad portfolio of payment solutions, including SoftPOS, designed to make tap-to-pay acceptance seamless. Contact us today to learn more about how we can help you deliver the payment experiences today’s consumers demand.