In our Contactless series across Europe, we have looked at a variety of countries, each at different stages of their digital payments journey. Whilst all have experienced big changes in consumer behaviour, much of it in response to the pandemic, the Nordic countries were already getting ready to say goodbye to cash before Covid-19 had even arrived.

Nordic nations account for 4 out of the 10 most cashless countries in Europe and are amongst the most cashless nations of the world[1], with Norway leading the way, closely followed by Finland, Sweden, and Denmark.

What is interesting about the Nordic countries is not so much that they are moving away from cash whilst other countries are not, rather that they are so much further along the journey to a digital society, giving those of us living elsewhere in Europe a glimpse of what might be coming soon to a country near you…

Early adopters in the dash from cash

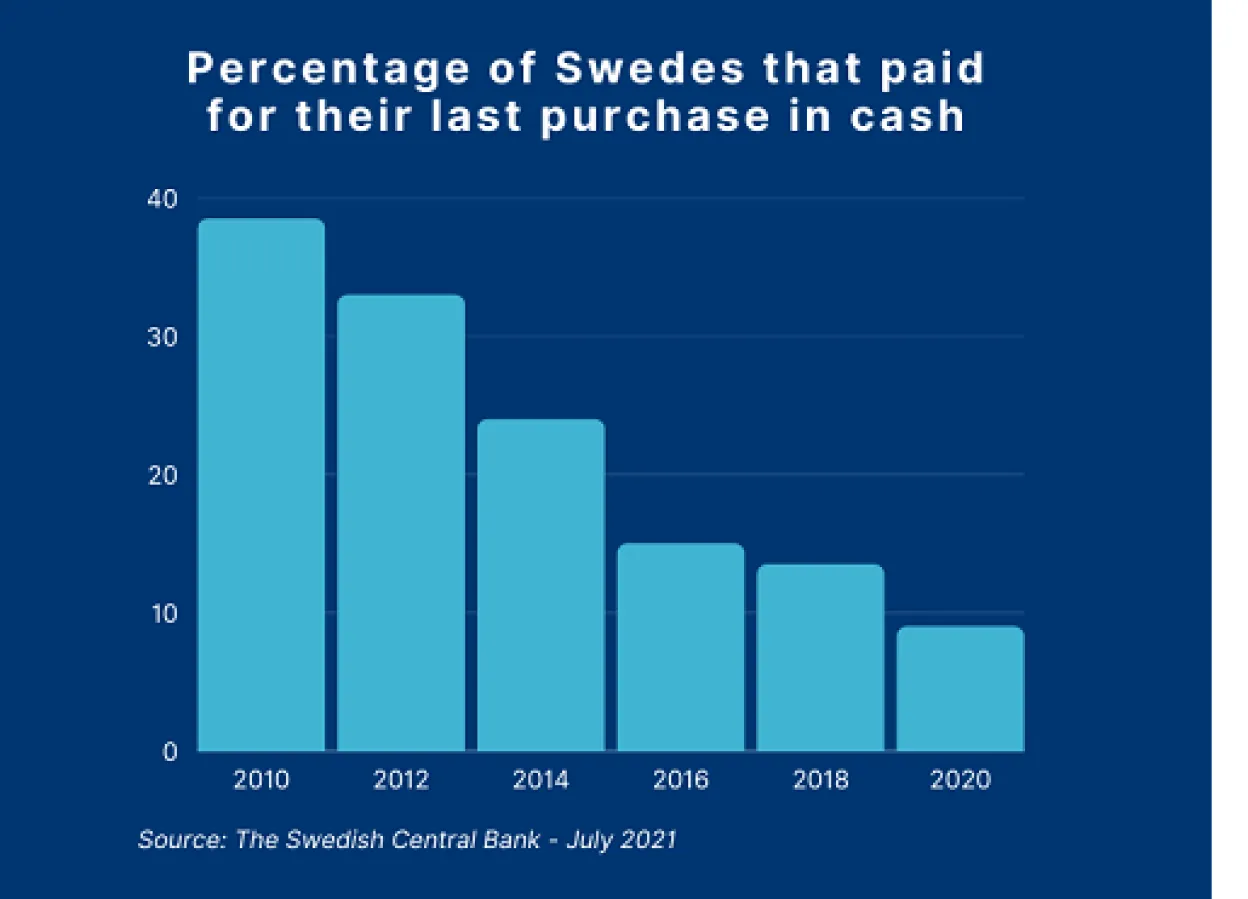

Sweden, one of the most technologically advanced nations on the planet, is predicted by some to become the world's first cashless society by March 2023[2]. In the last ten years, the proportion of goods paid for with cash has fallen from around 40 per cent to less than 10 per cent[3]. Cash is now mostly used for small payments and primarily by the older population. Many bank branches have closed, and of those that remain, the majority have stopped allowing customers to make cash transactions.

Earlier this year, Norges Bank, the central bank of Norway, reported that Norwegians are using coins and bank notes for just three to four percent of their financial transactions[4]. This news moved Norway into prime position as the most cashless Nordic country, ahead of neighbouring Sweden.

In 2020, 65% of payments at physical points of sale were contactless[5], a share which increased throughout the year with BankAxept reporting that 80 percent of payments in December 2020 were contactless.

Financial inclusion and financial exclusion have become uneasy partners

The paradox here is that whilst Sweden is viewed as being very successful at financial inclusion, with more than 99% of the population having a bank account[6], (the world average is 58%), there is also financial exclusion for those who rely on cash, such as the elderly or disabled.

This situation led The Riksbank, Sweden’s central bank, to adopt legislation at the beginning of 2021 under which the six largest banks are obliged to provide certain cash services, ensuring a minimum level of access to cash for consumers and companies.

The issue of exclusion has even surfaced in a reality tv show, Seniorsurfarna, or ‘Senior Surfers’, which sees celebrities sent to a training camp to learn about digitalisation and technical developments.

The dramatic shift away from cash has also caused concern in Norway. The country’s Finance Ministry has requested that Oslo’s Financial Supervisory Authority establish a plan to guarantee the availability of physical cash to customers, and avoid Norwegian banks denying that it’s their responsibility to offer these services, as has been the case in Sweden[7].

Meanwhile, the younger, tech-savvy consumers continue to soak up new digital technologies, with some even prepared to go to extremes. Thousands of Swedes have had a microchip implanted in their hand[8], enabling them to perform a variety of digital tasks, from confirming their ID to purchasing goods, all through the simple wave of a hand. The safety and security of this approach is a topic of debate, but it provides an eye-opening insight into the direction contactless technology is taking.

The prevalence of mobile payment apps is also driving digital payments

Like their Scandinavian neighbours, Finland are also big fans of digital payments. An impressive 98% of the population owns a debit card and 63% have a credit card. Denmark is also keeping up with the cashless trend, with 97% owning a debit card and 86% of in store payments now contactless.

But one of the biggest drivers of cashless and contactless payments in both countries, is the dominance of mobile payment apps. These have seen huge uptake across Scandinavia and enable consumers to pay for products, services, and bills, as well as sending money to each other.

In June this year, it was announced that a group of banks in Norway, Denmark, and Finland plan to merge their mobile payment apps to create one of the biggest services of its kind in Europe. Danske Bank is to merge its MobilePay app with the Norwegian app Vipps and the Finnish app, Pivo, thereby serving 11 million users with over 330,000 shops and online retailers. This merger will establish one of the largest bank-owned mobile payment providers in Europe[9].

The prevalent use of these apps in society means that it is quite common for a retailer with multiple payment points to provide some POS dedicated to cash and card, and others dedicated solely to mobile payment apps.

Back in Sweden, mobile payment application Swish is already close to being universally adopted. The app facilitated more than 300 billion kronor worth of transactions in 2020, three times more than Swedes withdrew from ATMs in 2019.

Digital currencies may be the next stage of the journey

As people use less physical cash and alternative currencies such as Bitcoin gain ground, many countries are looking at issuing their own central bank digital currencies (CBDC). The surge in contactless payments has served to sharpen the focus on digital currencies and once again, the Nordics are at the forefront of progress.

Earlier this year, Norway’s central bank publicly announced that it was researching digital currency options to help support the switch to a cash-free society. Sweden is already surging ahead with investment into the feasibility and development of the ‘e-krona’ with a decision expected by November 2022 on whether to proceed.

However, just as there has been resistance to digital payments, so nervousness remains about reliance on a digital currency. The Riksbank claim that they see the e-krona as a complement to cash, rather than a replacement. Does this put full digitalisation out of reach?

Only time will tell if digital currencies can gain traction, but there can be no doubt that the Nordics offer us the opportunity to observe some of the latest in payment innovations, and whether society really will embrace a fully cashless model.