There’s a silver lining to the unpredictability we experienced last year: 2020 accelerated the growth and advancement of the current payments landscape. In fact, the way operators set up their payment systems now will truly be a testament to how they thrive moving forward.

Payments have officially entered a new era, one that embraces innovation, convenience, and most of all, safety—and next-generation technology makes it all possible

Here are 5 payment trends that are forever changing the customer journey in food, beverage, and retail experiences and resulting in increased adoption, engagement, and loyalty.

1. Cloud technology will continue to rise

The accelerated integration of cloud technology is not a trend; it’s a revolution. In fact, according to International Data Group, 69% of businesses are already using cloud technology, and 18% say they plan to implement cloud computing solutions in the near future. Companies are eager to become more agile to be able to quickly respond to industry changes. The savings, flexibility, enhanced security, and mobility offered with cloud technology continues to drive increased adoption.

In point of sale, the cloud platform is easy to deploy, maintain and manage with the ability to make real-time changes from anywhere, anytime. Appetize’s native cloud technology allows an enterprise business to operate wifi, network, and offline, and Appetize is currently the only company in North America offering modern enterprise-level POS and digital ordering on a native, cloud-based platform.

2. Contactless payments will be the norm

Contactless payment technology has risen in demand faster than expected. According to a recent customer survey, 77% of Americans will prefer contactless payments even after the pandemic ends. Even Apple CEO Tim Cook says, “This contactless payment has taken on a different level of adoption. And that I think we’ll never go back.”

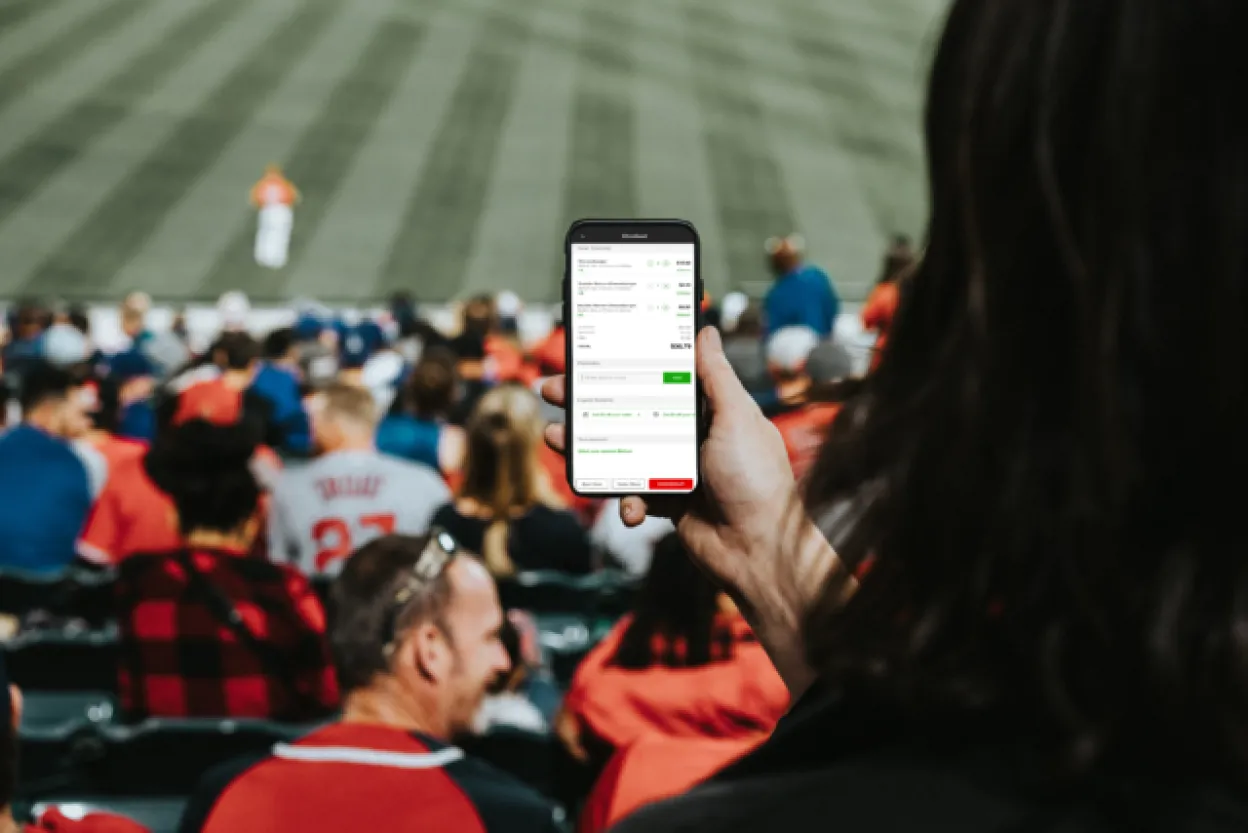

Contactless payments are rising because consumers are demanding touch-free payments. Whether it’s using ‘tap and go” payments, mobile wallets or stored and loaded value cards, you’ll see less cash and more touch-free concepts in this new “digital-first” payments era prioritizing convenience and safety.

Contactless payments are also great for business. Customers would spend up to four times the average amount in restaurants if they could use order ahead technologies (ie: through mobile ordering), according to recent data. If technology is offered for ordering, customers return 6% more often and spend 20% more each time.

Contactless payments goes beyond traditional terminals and kiosks. Virtual drive-thru, virtual hawkers and virtual waiters are forward-thinking concepts that innovate the contactless payment experience.

3. More businesses will convert to an omnichannel platform.

“Omnichannel” is an industry buzzword for 2021, and with good reason.

A unified, omnichannel platform offers both physical commerce (point of sale) and e-commerce channels (mobile and online ordering) in one system, providing operators modern, cloud POS, digital ordering, menu management, and advanced analytics to operate all sales channels from one system.

This is especially crucial for restaurants. The ability to support quick service, table service, drive-thru, self-service, mobile and online ordering, 3rd-party delivery, and retail transactions allows restaurants to offer guests improved experiences and the most convenient ordering options—while increasing their order volumes and revenue.

An omnichannel platform also allows technologies to integrate with a series of solutions or 3rd parties to meet all business needs for operations management. The legacy methodology of having a POS that provides everything from staffing to inventory to financial management no longer fits because solutions needed by one brand may only be 50% of another brands’ needs. Systems should integrate with best-in-class applications and not be an obstacle to running a business effectively.

4. Loyalty programs will increase.

Nearly half of Americans (48%) would dine at a restaurant more often if it offered a brand loyalty program. The most important factor for Americans to join a brand loyalty program? Discounts and special offers for future visits (54%); free food (27.5%); reaching a certain tier in a program (10%) and getting news and updates (5%).

Last year, a slew of quick-service restaurants—including McDonald’s, Taco Bell and Moe’s—developed loyalty programs, and more brands will follow suit in 2021. Loyalty programs have enormous benefits. Customers can earn and redeem points for discounts and incentives, but restaurants also have an advantage. They can personalize guest experiences and pull vital analytics and data to have a better understanding of their customers.

By embedding food, beverage, and retail ordering inside a branded, native mobile app, businesses can create a loyalty program, a great tool to keep customers coming back with incentives, like earning and redeeming points. This is all possible with an Open API, allowing 3rd party developers and partners to seamlessly integrate.

5. QR codes will make a major comeback

QR codes are experiencing a rebirth.

Customers are using their Smartphones to view menus, order, and pay for food, beverage, and retail with a convenient QR code scan, and businesses successfully thrive by supporting less cash and more frictionless ordering.

While QR codes have become a growing solution, and most businesses have adapted, the QR code technology continues to evolve — and the “location-aware” capability is the latest advancement operators are seeking.

A location-aware QR code provides the unique location information with each scan. Location identifiers contained in the QR code can include — and are not limited to — a table number, parking space, or seat at any business, whether a restaurant, stadium, marketplace, or event venue. The location-aware QR code technology lets both waitstaff and the kitchen know the specific location linked to a customer’s order, conveniently tracking where orders are placed to analyze traffic flow.

For instance, last year, Live Nation offered “Live At The Drive-In,” an outdoor, socially distanced concert series where guests could enjoy live entertainment from the comfort of their own designated tailgate space (which included a respective parking spot). For the concert series, Appetize integrated location-aware QR code signs spaced throughout the venue, and guests could scan the code with their phone to order food and beverage. Each scan signaled to the Live Nation staff the exact location/tailgate space the guest ordered from, allowing staff to deliver orders directly to them.

Jimmy Im is Director of PR at Appetize

This blog was originally published on the Appetize blog