Not so long-ago, companies relied on servers and systems that resided in their own premises. If more capacity was needed a new server would need to be spun up, a task that could take weeks and would then need to be maintained, kept up to date via patches and capable of scaling as the company grew over the following years. This was a complex and costly exercise, one that would frighten the hardiest of IT managers.

Then along came cloud computing, with its promise to simplify technological process by taking all that messy infrastructure and pipework out of the server rooms and into the Cloud – or rather, stored elsewhere, on servers owned by other companies, and made accessible to you via the internet. But it didn’t stop there. As Marc Andreessen pointed out, “software is eating the World” and the Cloud was helping it take bites out of the in-house and local platform, software and storage markets, becoming ever more prevalent in our daily lives.

What does ‘Cloud Computing’ bring to business?

The limitations of traditional IT infrastructure are becoming more apparent each year. Many businesses today are struggling to adapt to marketplace changes and new trends as their technological environments are inefficient at sensing and responding to these.

‘Cloud Computing’ frees you up from managing non-core activities so you can concentrate on what you, or your business, does best – whether that is consuming an endless stream of tv shows and movies on Amazon Prime, selling your sportswear apparel on Shopify like Gymshark, or in the case of Uber and Netflix - using solutions like AWS (Amazon Web Services) to host applications and data.

Cloud-based services offer a much more scalable and reliable IT infrastructure that is specifically designed to streamline business performance and support development and growth via scalability and elasticity. An infrastructure model that enables businesses to scale up or down based on fluctuations in demand, is increasingly important in the face of current and future uncertainty. Need more storage? Just increase your AWS service plan. Need Photoshop as well as Premier Pro? Just upgrade your Adobe Creative Cloud plan. It enables you to move from an upfront CAPEX cost model to a recurring OPEX model.

In the early days, Cloud services could be broken down into 3 key categories:

1. Infrastructure as a Service (IaaS) – Servers, Storage, Networking firewalls/security, datacentre. The virtual equivalent of a traditional data centre

2. Platform as a Service (PaaS) – IaaS + Operating systems, Development Tools, DB management and business analytics

3. Software as a Service (SaaS) – IaaS + PaaS + Hosted applications / apps

[The world has embraced the Cloud, (just ask the young family member logging into your Netflix account), and will continue to evolve towards an ever-fragmented service model mentality].

Together with IaaS and SaaS, Platform as a Service is one of the three primary levels of Cloud computing that is allowing businesses to redirect resources away from IT hardware, software, and personnel expenses, to focus on other business needs. In the UK, the public cloud market generated approximately 12.3 billion U.S. dollars of revenue in 2020. According to the Technology Market Outlook, revenue of this market is set to increase to some $23.8 billion by 2025. The IaaS market size was $67 billion in 2020 and is expected to grow 26.9% in 2021. In 2022 the PaaS market alone is estimated to reach $71 billion (figures from statista.com).

But how does all this apply to ‘me’, the customer? What is it I benefit from when opting into these services?

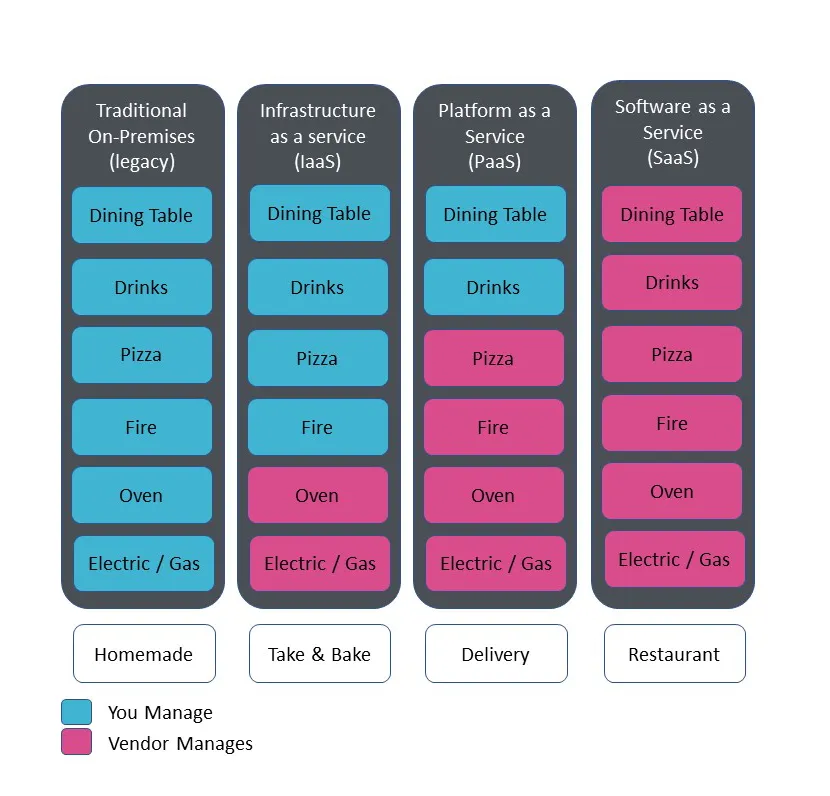

Let’s turn to a popular analogy first introduced by Albert Barron in 2014 – the ‘Pizza as a Service’ model to break down the ingredients that make these ‘as a service’ offerings so tasty:

- On-Premise — like a homemade pizza, made from scratch, you do everything yourself from sourcing the ingredients, cooking the pizza with your own equipment then serving it to you dining table with drinks (and doing the washing up). Example: A server room tucked away at the back of the office. You can make it exactly how you like, but you need to invest in all the kit and infrastructure, clean up the mess and maintain everything yourself.

- Infrastructure as a Service — You buy a readymade pizza and all you need to do is warm it up, however you can still customise some toppings. Example: An IaaS provider such as AWS (Amazon Web Services) is responsible for the entire infrastructure. You are responsible for installing/maintaining the apps and operating systems. For System Administrators.

- Platform as a Service - The pizzeria creates and cooks the pizza using their facilities, leaving you to collect or opt to have it delivered. Example: Servers, operating system updates, security patches and backup are managed for you. You can then focus on app development and data without worrying about infrastructure, middleware, and OS maintenance, for example building your software on a platform such as Heroku. For Developers.

- Software as a Service — You take your family to a restaurant where everything is taken care of, freeing you up to enjoy the experience and not worry about the washing up. Example: You can sign up for software directly like with Netflix, Instagram, Zendesk and PayPal, usually to ‘consume’ a product or service. For End Users.

Applying the ‘as a service’ model to the world of payments

The recent 2020 McKinsey Global Payments Report discusses the opportunities Payments as a Service (PaaS) can bring in changing the operating model for banks:

“Outsourcing of the full payments stack is a possibility, a new generation of technology providers has emerged allowing banks to expand quickly and modernise their payments product portfolio without incurring high upfront investment. Payments-as-a-service (PaaS) players operate cutting-edge cloud-based platforms to provide specialised services, such as card issuing, payments clearing, cross-border payments, disbursements, and e-commerce gateways.”

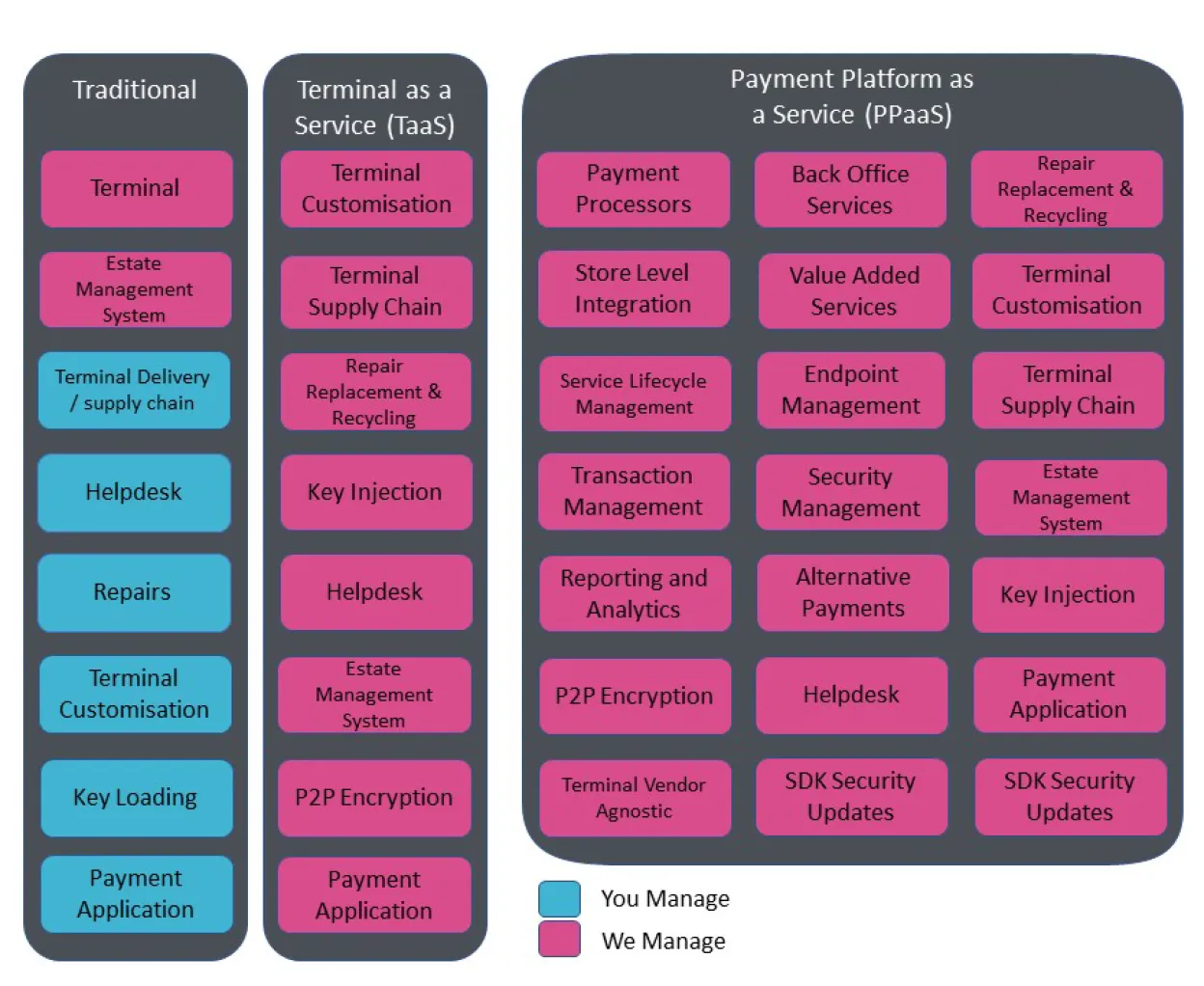

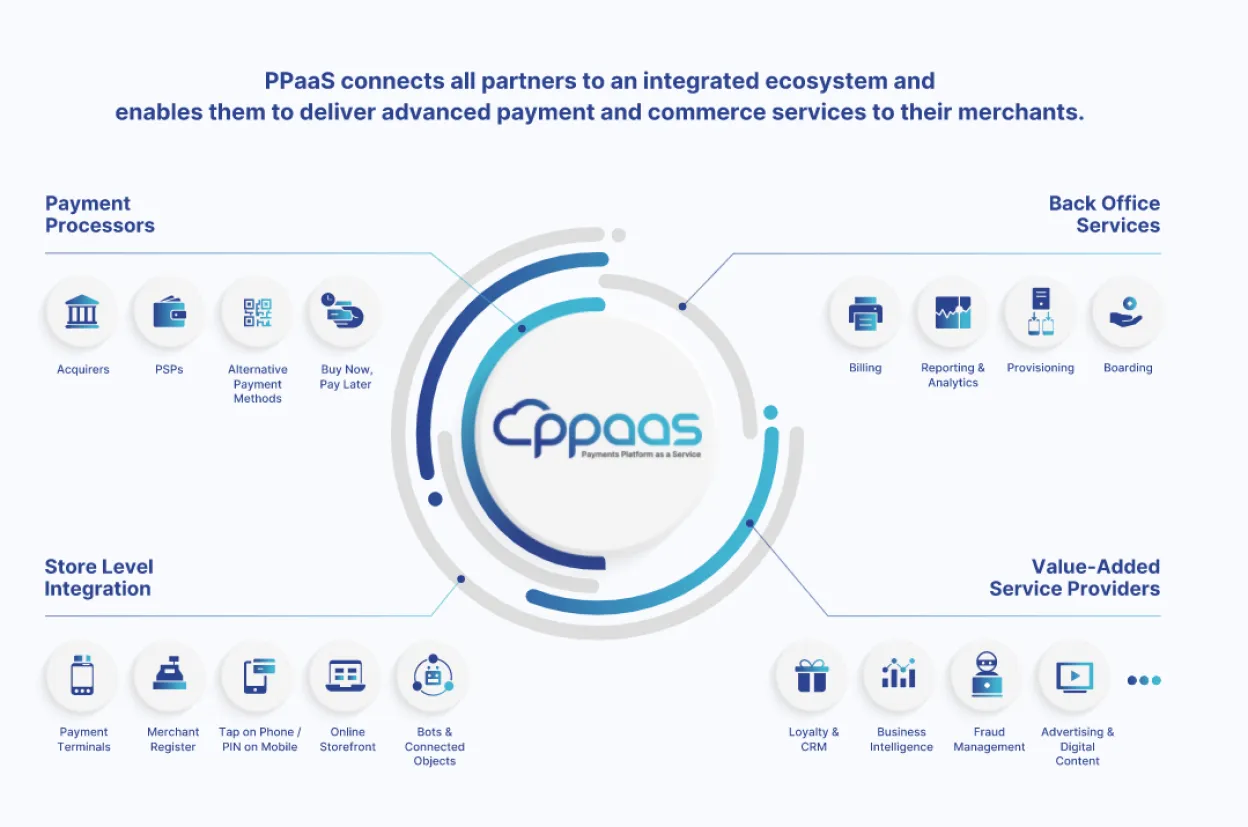

At Ingenico, we are building a world-class, cloud-based Payments Platform as a Service (PPaaS) that empowers our ecosystem of customers, integrators, and partners to offer merchants state-of-the-art payment and commerce solutions available anytime, anywhere. This solution looks to build upon our TaaS (Terminal as a Service) model which brings together a comprehensive suite of services covering the entire lifetime of a payment terminal, from installation to end of life management.

Returning to our pizza analogy, the move towards Payments Platform as a Service enhances Ingenico’s ability to provide a much richer set of value and services to our customers. Whilst TaaS secures the infrastructure for supporting services around payments hardware, PPaaS is the final destination that will provide cradle to grave, whole life management of terminals for customer estates. It shifts the perception from the ‘terminal’ to the ‘value chain’ of activity that supports our customers in a much more holistic way, one where we work to truly unlock the potential of hardware, software and support functions.

Delivering an agile payments ecosystem

In a world that seems to change faster and in ever stranger ways, we must be more adaptive and prepared. If business models, customer preference, external forces, security concerns or regulations change, then you need a way to quickly adapt and overcome these challenges while you are still running and without needing to slow to a stop.

Think of the electric Tesla cars. Fitted with a data connection, each car can receive software updates that unlock more performance. If the engineers find a way to better manage the battery payload, if a customer wants the full autonomous driving pack, then all it takes is a remote software update. What this means is less visits to the service station, cars that increase – rather than decrease in value, and happier customers.

PaaS is Ingenico’s vehicle to provide value, not just when a new terminal is delivered to a merchant, but at every stage of its lifecycle and extended value-adding eco system of services, updates and estate management. The model provides an environment where services can be managed more centrally, allowing estate managers to concentrate on delivering value to their customers by adapting to change and customer needs with more speed and flexibility. It reduces the risk of having to get it right from day one and allows the ecosystem to be agile in the way it customises and delivers value.

And the more the vendor can do to manage the product, service, and environment, the more the customer can relax and concentrate on enjoying their customised pizza…