Bringing Embedded Insurance to In-store POS terminals

Listen to this article

The insurance world is changing rapidly, blending technology and partnerships to redraw traditional boundaries. Traditionally, insurance has been seen as a separate service, bought independently from the main transaction. This often results in a complex and disconnected experience for customers.

From Standalone to Embedded Insurance

So, what exactly is "embedded insurance"? It refers to the seamless integration of insurance products into non-insurance platforms or transactions, making it more accessible and convenient for consumers. In this model, insurance coverage is part of the purchase process at the point of sale. In a few clicks, customers can choose tailored insurance plans that meet their needs.

Embedded insurance overcomes conventional barriers by offering insurance options directly during transactions, like shopping at retail stores.

Spotlight on Anycover, a Modern Product Protection Program

Anycover is a Singapore-based insurtech startup that aims to bring product protection to Southeast Asia's thriving retail and e-commerce space. Having a solid background in insurtech & investment, Anycover has a tight-knit team that met during the Antler SG-8 program in 2021. Founded during the Antler SG-8 program in 2021, and backed by prominent insurtech VC funds, Anycover offers an API solution that changes the extended warranties landscape. It enables SMEs to swiftly launch and manage their warranty programs without starting from scratch.

While big retailers have integrated extended warranty programs, smaller merchants often struggle due to long onboarding processes and minimum premiums imposed by insurers.

Anycover solves these problems by streamlining onboarding and pre-negotiating terms with leading insurers and a portfolio of well-known brand customers. This makes it simpler for merchants to select premiums that fit their business and their customers.

Unlocking In-store Embedded Insurance Opportunity with Ingenico's StartupIN Program

This partnership utilizes terminal capabilities to provide insurance options at the point of sale, enhancing the shopping experience and creating new opportunities for insurance sales. Anycover and Ingenico's Startup IN program are set to change the way insurance and retail interact.

Here's how it works:

When a customer makes a purchase, the cashier presents extended warranty/insurance options based on the product and category. These options come from Anycover's network of trusted insurers. Customers select their preferred warranty duration at the POS terminal, and the cost is added to the checkout total. A policy document is then securely generated, with a guide to the claims process if necessary.

Business Benefits

- New Revenue Streams: For businesses, embedded insurance introduces an additional revenue stream. Partnerships with insurance providers allow them to earn a commission on each sale while enhancing customer loyalty through value-added services.

- Competitive Edge: Offering embedded insurance demonstrates a commitment to customer well-being beyond the immediate transaction. This can differentiate businesses in a competitive market, attracting customers who value a comprehensive and customer-centric shopping experience.

Consumer Advantages

- Simplicity and Convenience: Embedded insurance saves consumers from navigating complex offerings, providing relevant options within a single transaction.

- Instant Coverage: Customers quickly access insurance coverage without lengthy application processes, especially in urgent situations.

In a Nutshell

Think of this as an aftercare service for a wider range of retail SMEs. The emergence of embedded insurance at in-store payment terminals is a pivotal moment for the insurance sector. By integrating insurance into everyday transactions, businesses improve the customer experience, establish new revenue sources, and get a competitive edge. Consumers benefit from simplicity, convenience, and personalization. This approach continues to evolve the insurance landscape, paving the way for a more integrated, customer-focused future.

Thoughts to Consider

Consider how often you've bought, say, an expensive electronic item, and later purchased an additional warranty from a third party.

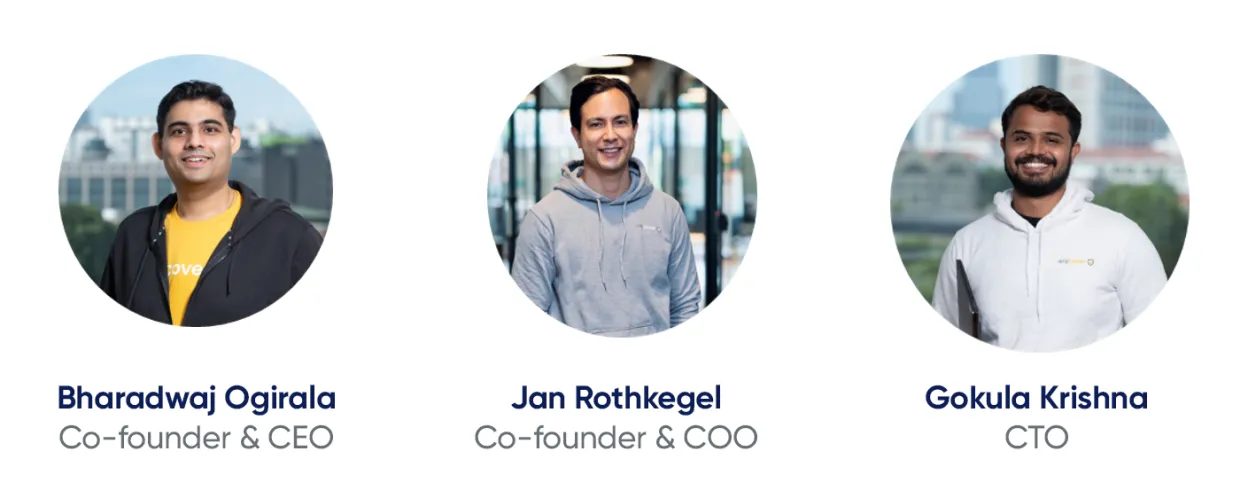

Meet the Anycover Team

About the StartupIN Program

The Ingenico StartupIN Program focuses on start-ups that are in-store natives or have plans to enter the in-store space, whether they are a FinTech or a SaaS provider. Designed for early-stage start-ups (Series A or below) that are looking for go-to-market routes in the in-store commerce space.

Through the program, startups will get access to Ingenico’s technology stack, payment expertise, and commerce ecosystem. It also serves to promote the collaboration between the program alumni and Ingenico to ecosystem partners.

As a global leader in payment solutions, Ingenico has consistently championed innovation in the digital commerce space. The StartupIN program is a platform to foster and cultivate groundbreaking ideas within the company and to collaborate with emerging startups to develop transformative solutions.

The embedded insurance project is a testament to the program's success, combining Ingenico's industry expertise with the fresh perspectives of startups to create revolutionary offerings.