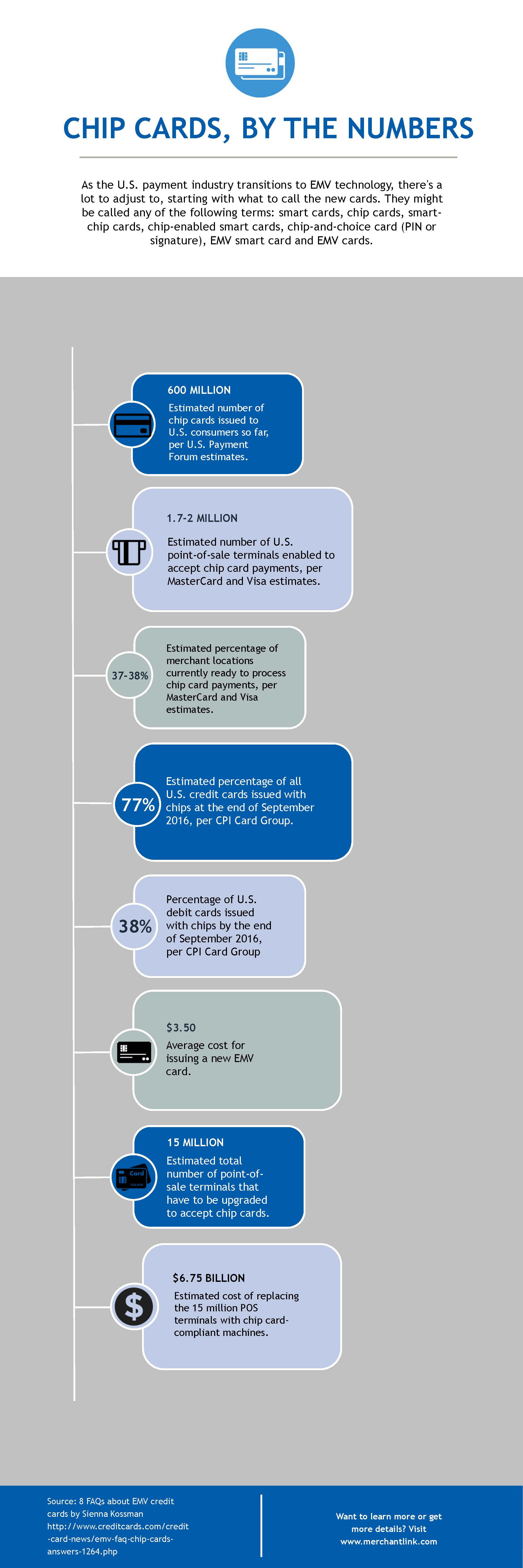

The switch to EMV is well underway in the United States. This means new processes for customers and merchants. Some customers are seeing the changes more than others, but more will be coming soon. This switch involves new in-store technology and internal systems for merchants, as well as learning new payment processes for consumers. But ultimately, this brings greater protection against counterfeit fraud. CHECK OUT THE INFOGRAPHIC: Chip Cards, By the Numbers, to learn interesting stats on EMV and chip cards.

Laura Meck is the EVP, Sales & Marketing at Merchant Link

Laura Meck is the EVP, Sales & Marketing at Merchant Link

As a convenience, this article provides links to websites maintained by third parties. Merchant Link does not endorse, does not provide and is not responsible for the availability, security, products, services, or content offered through these third-party websites. In addition, our privacy policy does not apply to these third-party websites. These third-party websites may have privacy policies that differ from our privacy policy and may provide less security than our website. You should consult the privacy policies on any of the third-party websites for further information.